Storms and headwinds are taking it in turn to try to derail an incredibly robust property market. After more than 20 years of sustained price growth with +10% a year on average, the property market has, since 2015, had to face one after the other, an historic increase in taxation, Brexit, Covid and now the war in Ukraine. Will the resulting global economic crisis with the extreme rise in the price of energy and raw materials, and the massive inflation which ensued everywhere (and in the UK in particular) finally bring down property prices in London?

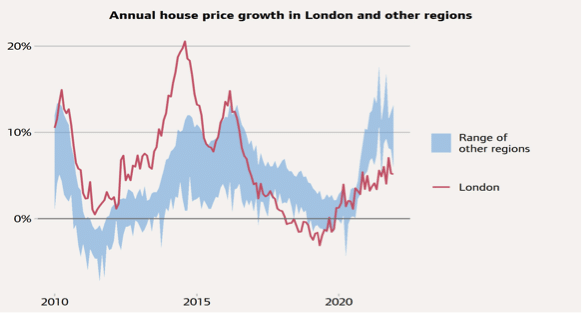

In 2015, the sharp rise in stamp duty on high value assets was responsible for a significant but contained drop of around 15% of the premium market (assets worth more than £2M) over a period of 5 years. Prices have since started to rise again and this drop has now been made up for. As for the rest of the market, growth is certainly no longer 10% or even 20% a year, as it was in 2013 and 2014 but prices have remained robust and have continued to grow by a few percentage points per year, despite Brexit and Covid. Some areas have increased in value more than others. Houses and apartments with outdoor spaces, which are in high demand since the pandemic, have seen their value increase more significantly. The word on the street up to the end of spring was that the market was growing and just waiting to pick up again. Since then, the dark clouds of inflation and the ensuing rise in interest rates have loomed on the horizon. Is this the end of a long boom for the London property market?

How can the resilience of the English and the London real estate market up till now be explained?

Undeniably, the tax increase applied in 2015 (increase in stamp duty on assets over £900K, an additional 3% for any purchase if you already owned a property anywhere in the world with an extra 2% if you were not resident in the UK), Brexit and the pandemic have contributed to the market slowdown. Certain undeniable and structural parameters have not changed though foremost of all: supply and demand. Brexit or no Brexit, the United Kingdom and London in particular remain very attractive. London is still an incredibly popular world capital renowned for its dynamism, its cultural melting pot, its schools and universities, the English language, the ease of doing business and investing, security, etc. Brexit clearly makes things a little more complicated than before. Europeans aspiring to come and settle must now obtain a visa. Nevertheless, the fact is that the population continues to rise. Demand therefore remains strong.

What about the offer side of things? It is common knowledge that it is too low. Since 2020, the government has aimed to build 300,000 new houses every year, a target which year on year, is far from being achieved. This imbalance therefore contributes structurally to the strength of the market.

Moreover, the successive crises haven’t done anything to reassure sellers who tend not to rush a move and opt to wait and see. The inventory of properties for sale is therefore low or even very low, increasing pressure on prices due to constant demand.

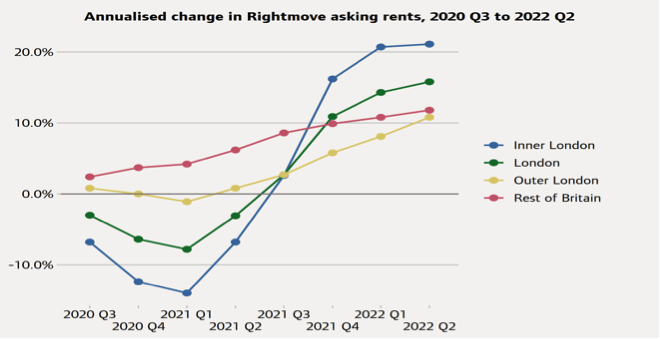

The additional stamp duty on rental properties and the requirement for substantial deposits have been unfavourable to Buy to Let investments since 2015. At the time, the objective for the government was to promote access to property, especially for first-time buyers, by reducing the buying pressure and slowing the rise in prices. This strategy may have worked to some extent, but it has also contributed significantly to the lack of housing currently available for rent and, therefore, to the increase in rents, which were already very high. This is bad news for tenants who have become less and less willing to finance their landlord’s assets. Access to property has therefore become vital for those who can afford it.

Source: Rightmove quaterly asking rent data

Source: ONS, UK House Price Index

What’s next?

We thought we had seen it all but no. Barely recovered from the pandemic, we now have to face the war in Ukraine: its tragedies, the upheavals and the resulting global economic crisis. Galloping inflation is approaching double digits and central banks have no choice but to raise interest rates.

In the UK, interest rates on a residential mortgage have gone from 1.5% to almost 4% in 2 months. This will obviously not boost the property market. Should we expect a crash though? Unlikely….

Indeed, interest rates are far from being at record levels and banks have already taken measures to limit the levels of monthly repayments by lending for longer periods, up to 50 years instead of the usual 25 years – depending on the age of the borrowers. Another important parameter is the amount that the banks are ready to lend. It is normally proportional to the income of the buyers. About 5 times your salary today but it could be revised upwards.

Stamp duty is currently high and could also be reduced if necessary to boost the market and increase the number of transactions. Measures on taxation could also be taken to relaunch investment in Buy to Let.

The pound sterling continues to fall against the dollar in particular, making the market attractive for foreign buyers and investors who could make the most of it especially in the premium market.

Finally, people still want to own their property and rising rents are not likely to reverse the situation. Even if the economic situation was to become catastrophic, properties in London may well continue to be perceived as a safe haven where alternative investments and even non-investments could prove to be riskier. This is our view. Although forecasts like Savills below have been revised down slightly, PCL or Prime Central London properties still represent an attractive proposition.

In conclusion, the economic situation is likely to slow down the dynamism of the market in the medium term, but strong demand and various dynamic levers should be able to compensate. The question therefore is “Can I buy?” and not “Should I buy?” as rents are not about to drop.